Property Buying Guide

Your Step-by-Step Guide to Buying Property with Ghandhara Estate

Welcome to Ghandhara Estate — your trusted real estate partner in Islamabad and Rawalpindi.

We specialize in property sales, purchases, rentals, and construction across CDA sectors, DHA Islamabad, Bahria Town, and surrounding areas. Whether you’re an investor or a homebuyer, our mission is to help you make informed and profitable property decisions with complete confidence.

Buying property in Pakistan is an exciting milestone — but it also requires careful planning, market understanding, and reliable guidance. This Property Buying Guide will walk you through every step of the process, ensuring a smooth and successful purchase.

Buying a property is a long-term financial commitment. Before starting your search, carefully evaluate your finances:

Available savings and assets

Monthly income and ongoing expenses

Loan or mortgage options (if applicable)

Be realistic about your total cost — including taxes, transfer fees, and registration expenses — so you can make a smart investment decision.

Before viewing homes, decide what matters most to you:

Number of bedrooms and bathrooms

Car parking availability

Kitchen and dining preferences

Garden or terrace space

Proximity to schools, markets, and offices

Share these details with your Ghandhara Estate agent. Clearly mention your priorities — what’s essential, what’s flexible, and what you’d like to avoid — so we can find the perfect property for your needs.

Buying a newly built home has many advantages:

No need for major repairs or renovations

Option to select finishes and layouts before construction

10-year builder warranty (in most projects)

High energy efficiency with modern construction standards

No property chain — faster transactions

Possible part-exchange or installment options offered by developers

New projects in DHA, Bahria Town, and CDA Sectors are especially popular among overseas Pakistanis due to modern facilities and strong investment potential.

The right neighborhood can greatly affect your lifestyle and property value. Research key factors such as:

Current and projected property prices

School quality and healthcare facilities

Transport links and road access

Security, utilities, and amenities

Our experienced agents can guide you through top-performing areas in Islamabad and Rawalpindi — helping you find a home that fits your lifestyle and future plans.

Use all available resources — photos, videos, floor plans, and brochures — before visiting.

During the visit, pay attention to:

Construction quality and layout

Natural lighting and ventilation

Noise levels and neighborhood condition

Legal possession and utility connections

Our agents accompany you to ensure transparency and clarity at every stage.

When you find the right property, it’s time to make an offer. Consider:

Recent sales of similar properties

Seller’s urgency to move

Required repairs or upgrades

Current market demand

Set a maximum budget and stay firm. If the property needs work, use that to justify your offer. Negotiation is about balance — getting a fair price that works for both sides.

Once your offer is accepted:

Ask the seller to take the property off the market.

Verify ownership documents and property title.

Confirm what’s included (fixtures, fittings, furniture, etc.).

Prepare legal documents and arrange title transfer.

Pay the deposit (usually 10%–20% of property value).

Note:

If the buyer withdraws, the deposit may be forfeited.

If the seller withdraws, they are legally required to return double the deposit to the buyer.

Completion usually takes 4–6 weeks, allowing time for payments and legal processing.

Once payments are settled and ownership is officially transferred, you’ll receive possession of your new home.

Welcome to your property — and to the Ghandhara Estate family.

Best wishes from Ghandhara Estate

Building Trust Through Every Transaction

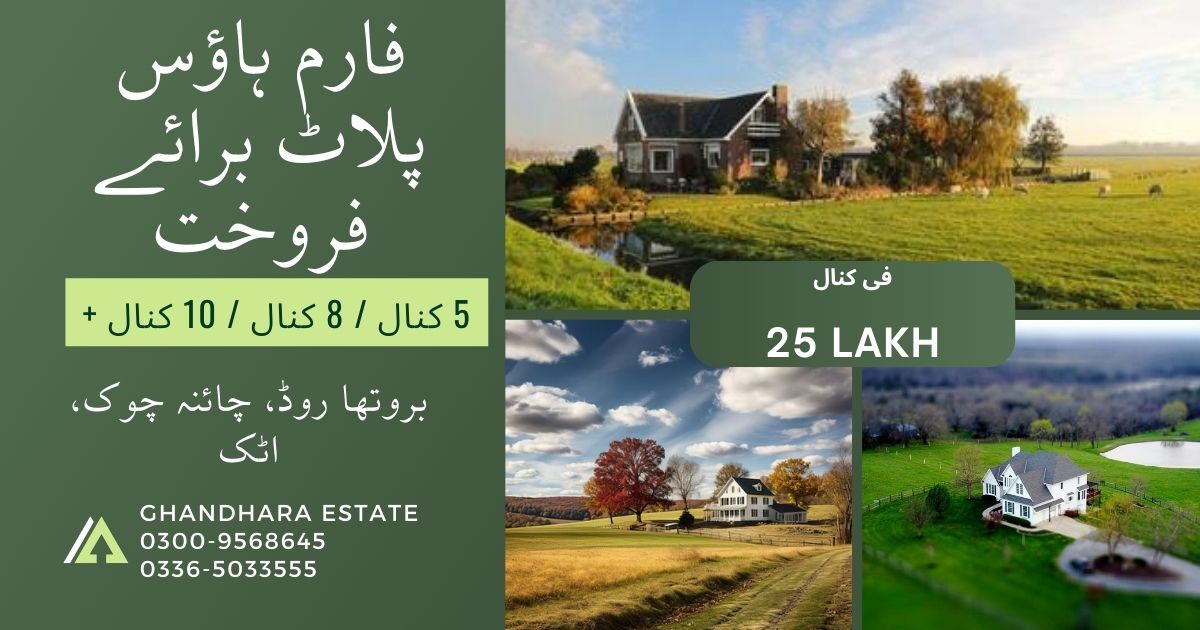

Farmhouse Plot for Sale in Attock – Ghazi Barotha Road, Off China Chowk

Escape the city hustle and indulge in a peaceful, pollution-free…

Rs25 Lakh Per Kanal

House for Sale in Islamabad G-13

Triple-Story Corner House in Islamabad G-13 Location:G-13, IslamabadFacing Kashmir Highway…

Call Us for Price Quote.